Gold Price Outlook: XAU/USD Prices Rise on Renewed Rate Cut Hopes

- August 5, 2024

Gold (XAU/USD) Analysis

- CPI , USD and yields drive gold prices higher

- Gold breakout attempt – bullish continuation in focus

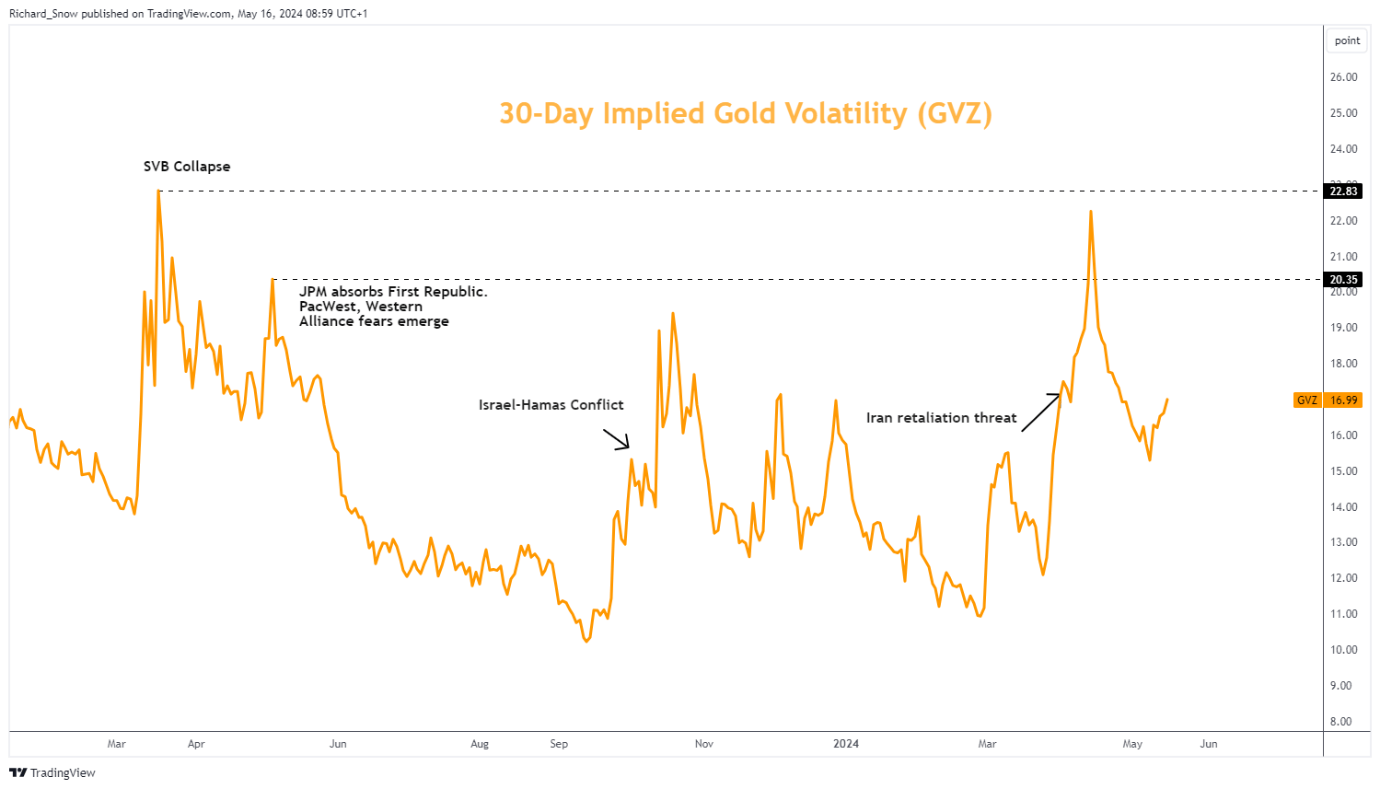

- Current levels of gold volatility may be insufficient to extend gold gains

- Gold market trading involves a thorough understanding of the fundamental factors that determine gold prices like demand and supply, as well as the effect of geopolitical tensions and war. Find out how to trade the safe haven metal by reading our comprehensive guide:

CPI, the Dollar, and US Yields Drive Gold Prices Higher

US CPI always has the power to propel markets given the amount of media attention and recent struggles as price pressures have accelerated over the past two months. It was, therefore, a relief to many when monthly CPI dropped form a prior 0.4% to 0.3% and both headline and core measures printed lower (but in line with estimates) too.

The dollar – measured by the US dollar basket (DXY) – immediately sold off, allowing gold to rise in the aftermath. The precious metal is viewed more favourably when interest rates are expected to come down as it means the opportunity cost of holding the non-interest bearing asset is lowered. US Treasury yields were seen sharply lower, adding to the positive catalyst for gold

US Dollar Basket (DXY) 2-Hour Chart