Gold Price Outlook: XAU/USD Turns on Hawkish Fed, Stronger USD and Yields

- August 12, 2024

Gold (XAU/USD) Analysis

- Hawkish FOMC minutes deliver a harsh dose of reality

- Gold on track for largest weekly drop since December

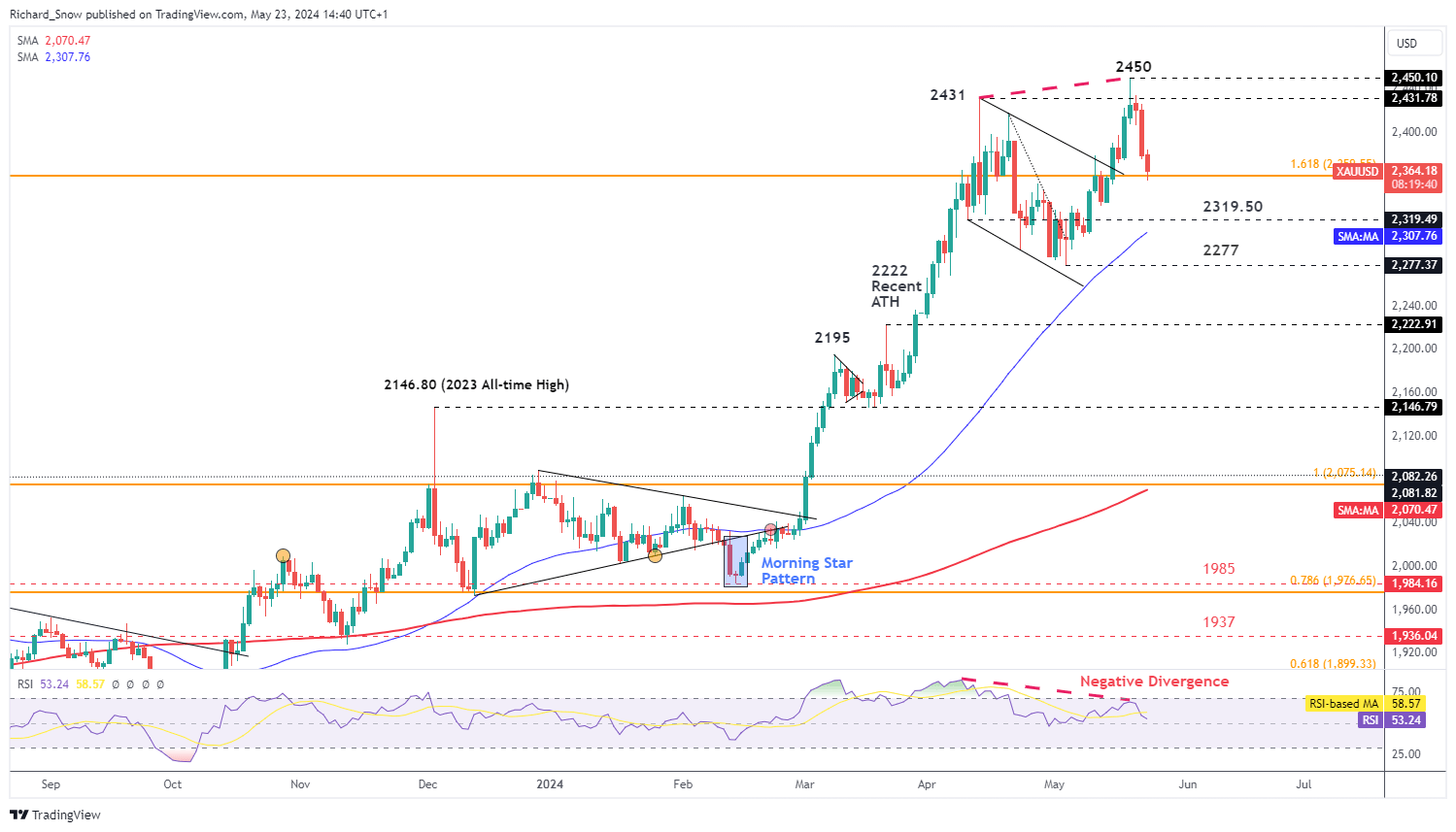

- XAU/ USD daily chart highlights negative divergence as bullish momentum wanes

- Gold market trading involves a thorough understanding of the fundamental factors that determine gold prices like demand and supply, as well as the effect of geopolitical tensions and war. Find out how to trade the safe haven metal by reading our comprehensive guide:

Hawkish FOMC Minutes Deliver a Harsh Dose of Reality

The FOMC minutes released last night brought with it a renewed focus on the problem at hand, inflation. The April US CPI managed to snap a run of hotter-than-expected inflation readings, a reason to breathe a slight sigh of relief but the FOMC minutes reminded markets of the harsh reality that lies ahead.

Participants at the meeting envision it will take longer than previously thought to acquire the necessary confidence that inflation is moving sustainably towards the 2% target. In addition, various participants discussed their willingness to tighten policy further should risks to the inflation outlook deem it appropriate.

As a result, the rate sensitive 2-year Treasury yield rose, as did the US dollar – weighing on the precious metal as can be seen below.

Spot Gold, DXY (green line) and US 2-year Treasury Yields (purple line)